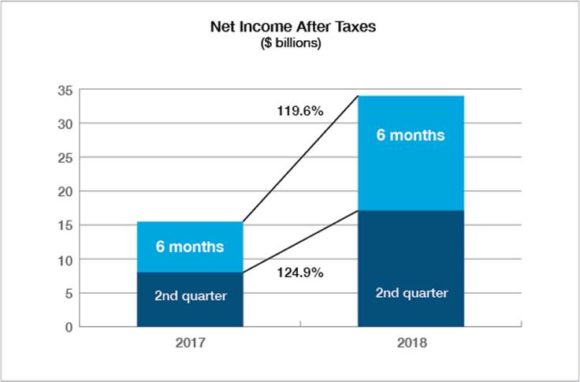

U.S. property/casualty insurers saw their net income after taxes more than double to $34 billion in first-half 2018 from $15.5 billion in first-half 2017, with the help of lower catastrophe losses, growing premiums, and an increase in investment income, according to a results report from Verisk’s ISO and the Property Casualty Insurers Association of America (PCI).

Losses and loss adjustment expenses from catastrophes declined to $14.6 billion for first-half 2018 from $18 billion a year earlier.

Net written premiums grew 13.3 percent in first-half 2018 from 4.1 percent a year earlier, affected in part by the growth in the economy, rising auto premiums, and changes that multiple insurers made to their reinsurance arrangements apparently prompted by the recent U.S. tax reform, according to the report.

Overall, insurers enjoyed a $6 billion net underwriting gain, rebounding from a $4.6 billion net underwriting loss for first-half 2017. Insurers’ combined ratio improved to 96.2 from 100.7 for first-half 2017.

Net investment income jumped 14.6 percent to $26.8 billion from $23.4 billion, with the increase mostly due to large dividends from insurers’ subsidiaries that don’t operate in property/casualty insurance.

Policyholders’ surplus increased $10.4 billion to a new record-high $761.1 billion as of June 30, 2018, from $750.7 billion as of December 31, 2017.

The $34 billion in first-half 2018 net income after taxes is considerably above the $19.8 billion average first-half income for the last 10 years and is the highest first-half income in history in nominal dollars. The increase in net income after taxes drove insurers’ annualized rate of return on average surplus to 9.0 percent—more than double the 4.4 percent for first-half 2017 and 0.7 percentage points above the average annualized first-half rate of return for 1988–2017.

Robert Gordon, PCI senior vice president, noted that insurers still face the tail end of the wildfire and hurricane seasons, including losses from Hurricanes Florence and Michael, but said “the industry is in good health with a strong balance sheet to serve consumer needs.”

Topics Carriers Profit Loss Property Casualty

Was this article valuable?

Here are more articles you may enjoy.

Carnival Puts Miami Headquarters Up for Sale as Florida Real Estate Soars

Carnival Puts Miami Headquarters Up for Sale as Florida Real Estate Soars  JPMorgan Client Who Lost $50 Million Fortune Faces Court Setback

JPMorgan Client Who Lost $50 Million Fortune Faces Court Setback  USAA to Lay Off 220 Employees

USAA to Lay Off 220 Employees  Wildfires Are Upending Some of the Safest Bets on Wall Street

Wildfires Are Upending Some of the Safest Bets on Wall Street